When diving into the dynamic world of cryptocurrency trading in Australia, two platforms often come to the forefront for crypto enthusiasts: CoinSpot and BTC Markets. Both exchanges are well-established in the Australian market, each offering a unique set of services tailored to the needs of Australian investors.

In this comparison, we’ll explore the nuances of each platform, helping users discern the subtle differences and distinct advantages that might influence their choice of exchange.

At a glance

| Category | CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | BTC Markets Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | Melbourne, Australia | Richmond, Victoria, Australia |

| Fiat Currencies Supported | AUD | AUD |

| Total Supported Cryptocurrencies | 441+ | 32+ |

| Trading Fees | 0.10% - 1% | -0.05% - 0.20% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, BPAY | Bank Transfer, Cryptocurrency, Osko |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Facebook, Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full CoinSpot review | Read full BTC Markets review |

| Visit | Visit CoinSpot | Visit BTC Markets |

About CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

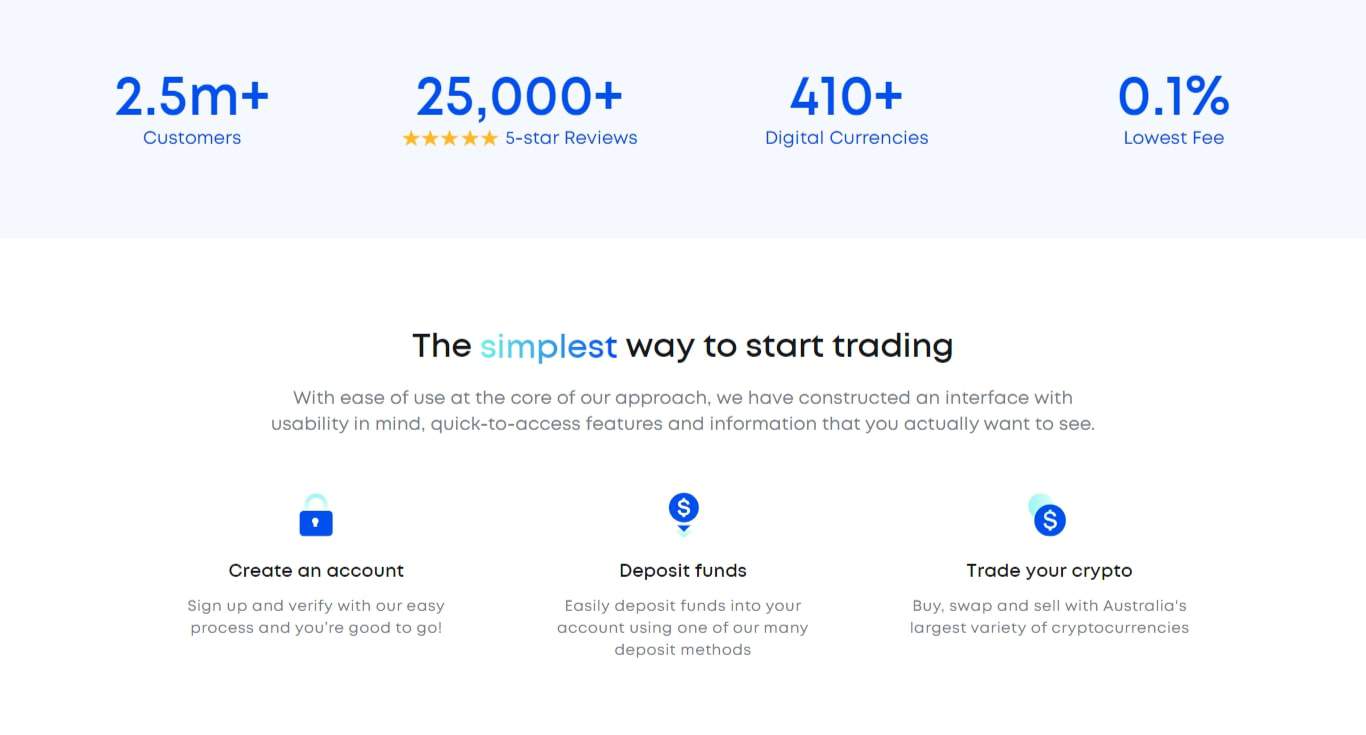

CoinSpot is one of Australia’s most popular cryptocurrency exchanges, with a reputation for ease of use and a wide variety of digital assets available for trading. Founded in 2013, CoinSpot has established itself as a leading platform for Australians to buy, sell, and store cryptocurrencies.

The exchange prides itself on its simple and user-friendly interface, which is suitable for both beginners and seasoned traders. With a focus on security, CoinSpot offers features such as two-factor authentication and custom withdrawal restrictions to protect users’ funds. The digital currency landscape in Australia took a significant turn with the advent of CoinSpot, an exchange that has been central to shaping the regional market.

Its journey has been marked by a commitment to simplifying the crypto experience, making it accessible to a broad audience. This dedication to user-friendliness has allowed CoinSpot to adapt quickly to changing market demands and technological advancements, which in turn has helped to solidify its position as a trusted name in Australian cryptocurrency circles.

Its role in fostering the acceptance of bitcoin and other digital assets has been pivotal, as it continues to broaden its portfolio of coins, catering to both novice and experienced investors seeking diversity in their crypto holdings.

CoinSpot Pros & Cons

Pros

Cons

About BTC Markets Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

BTC Markets, on the other hand, is an Australian cryptocurrency exchange that has been in operation since 2013. Catering to more experienced traders, BTC Markets offers advanced trading features and has built a reputation for providing reliable and professional services.

The platform supports a variety of fiat currencies and digital assets, promoting seamless deposits and withdrawals. BTC Markets emphasizes its commitment to compliance and security, adhering to local regulations to ensure a safe trading environment. Since its inception, BTC Markets has been interwoven into the narrative of cryptocurrency evolution in Australia.

As a platform that has consistently targeted more seasoned players in the crypto space, it has been influential in establishing a professional trading desk environment. BTC Markets has responded to the complexities of the digital currency exchange with a robust system that appeals to those with a deeper understanding of market dynamics.

The platform’s journey has seen it navigate the waters of regulatory changes, price volatility, and investor sentiment, emerging as a cornerstone for sophisticated crypto exchange options in the Australian market, and positioning itself as an indispensable resource for traders seeking a robust and regulatory-compliant trading environment.

BTC Markets Pros & Cons

Pros

Cons

CoinSpot vs BTC Markets: Supported Cryptocurrencies

In terms of total cryptocurrencies available, CoinSpot users have access to more cryptocurrencies. CoinSpot offers 441 cryptocurrencies whereas BTC Markets supports 32 cryptocurrencies. In this case, BTC Markets limits access to a large number of cryptocurrencies, which can be a problem for many traders.

For those interested in trading high market cap cryptocurrencies, CoinSpot supports 27 of the top 30, compared to BTC Markets which supports 14 of the top 30.

CoinSpot supports a significantly higher number of cryptocurrencies compared to BTC Markets. With this in mind, CoinSpot definitely has the edge for people looking to trade a wider range of cryptocurrencies.

CoinSpot vs BTC Markets: Fees

| Fee Type | CoinSpot Fees | BTC Markets Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 0% | 0% |

| Deposit Fee (Credit Card/Debit Card) | 2.58% | - |

| Trading Fee | 0.10% - 1% | -0.05% - 0.20% |

| Withdrawal Fee (Bank Transfer) | 0% | 0% |

When it comes to fees, both CoinSpot and BTC Markets structure their charges in ways that aim to be competitive and fair to their users. Generally, both platforms adopt a maker-taker fee model, which incentivizes liquidity providers with lower fees while charging those who take liquidity from the market slightly higher fees.

Neither exchange employs a one-size-fits-all approach to fees, opting instead for a fee structure that varies based on factors such as transaction size and trading volume. Fee structures in cryptocurrency exchanges are as varied as the platforms themselves, with each adopting a strategy that balances competitiveness with sustainability. Both CoinSpot and BTC Markets have embraced this philosophy, crafting fee schedules that reflect their understanding of market makers’ and takers’ roles in liquidity and trading volumes.

Their approaches to fees underscore a recognition of the diverse needs within their respective user bases. By offering fee models that scale with user activity, both platforms demonstrate their commitment to providing a cost-effective trading environment that aligns with the financial habits and strategies of their clientele.

CoinSpot vs BTC Markets: Security

In terms of security, both CoinSpot and BTC Markets place a high priority on protecting their customers’ assets. CoinSpot uses a multi-layered approach, incorporating systems such as two-factor authentication and cold storage for the majority of crypto assets.

BTC Markets also employs stringent security measures, including real-time monitoring and adherence to Blockchain Australia’s code of conduct. Each exchange aims to provide peace of mind for users through adherence to strict security protocols and a proactive stance on security management. Security remains a paramount concern for any crypto exchange, and both CoinSpot and BTC Markets have crafted their reputations around robust security practices.

These entail not only the implementation of advanced technology like cold wallets and two-factor authentication (2FA) but also a commitment to continuous review and improvement of security protocols. By employing a combination of hardware and software solutions, educating users on security best practices, and maintaining rigorous operational procedures, these platforms ensure an additional layer of security.

Their proactive measures serve to reassure users that their digital currency assets are managed with the utmost care, in line with international standards for cybersecurity.

CoinSpot vs BTC Markets: Ease of use

Ease of use is a critical factor for many users, and here, CoinSpot shines with its intuitive interface and straightforward navigation, positioning itself as an accessible platform for newcomers to the crypto community. BTC Markets, while maintaining a user-friendly interface, targets a more experienced clientele with a layout that supports complex trading strategies and a detailed market insight. The user experience is often the deciding factor for users weighing their options between crypto trading platforms.

CoinSpot’s design philosophy has always centred around ease of use, offering a clean, uncluttered interface that demystifies the trading process for newcomers. BTC Markets, while also prioritising a frictionless user experience, adds a layer of complexity suited to the nuanced needs of veteran traders.

The difference in their ease-of-use philosophies reflects a deeper understanding of their target user profiles, providing environments that are not only easy to navigate but that also resonate with the specific trading approaches of their users.

CoinSpot vs BTC Markets: Support

Customer support is a vital part of any trading platform. CoinSpot boasts a dedicated customer support team that’s received accolades for its responsiveness and helpfulness.

BTC Markets also provides reliable customer support, with an emphasis on professional assistance for more complex trading inquiries. Both exchanges strive to maintain high standards of service, ensuring that users receive the support they need in a timely and efficient manner. The importance of responsive and knowledgeable customer support cannot be overstated in the fast-paced world of cryptocurrency trading.

Both CoinSpot and BTC Markets recognise this, investing in support networks that ensure users’ questions and concerns are addressed with the same urgency and attention to detail as their trading platforms. CoinSpot’s customer service team is known for its friendly and prompt assistance, indicative of a deep-seated commitment to customer satisfaction.

BTC Markets’ support, while equally attentive, brings a level of technical expertise to the table that speaks volumes about their understanding of the complex issues that can arise in a professional trading environment.

CoinSpot vs BTC Markets: Features

Both CoinSpot and BTC Markets offer a range of trading features tailored to their customer bases. CoinSpot is renowned for its wide variety of cryptocurrencies and additional features like instant buy/sell options, making it a versatile choice for casual traders.

BTC Markets, with its emphasis on advanced trading tools and extensive market data, caters to users looking for a more in-depth trading experience. Navigating the diverse features of a crypto exchange can be as exhilarating as it is overwhelming, which is why both CoinSpot and BTC Markets have carefully curated their offerings. CoinSpot’s approach to features is inclusive, providing options that cater to a wide gamut of trading styles and preferences, without overwhelming the user.

BTC Markets, in contrast, delves into the granular details of trading, offering sophisticated analytical tools and a depth of market insight that aligns with the expectations of an experienced investor. This strategic delineation of features displays a keen awareness of the type of trading experience each user segment is seeking.

Final Thoughts

Deciding between CoinSpot and BTC Markets will largely depend on an individual’s trading needs and preferences. CoinSpot is often favoured by those seeking a straightforward and comprehensive crypto exchange experience, boasting an extensive selection of coins and a focus on user security.

BTC Markets appeals to traders looking for a platform with advanced features and a professional trading environment. Ultimately, both exchanges serve as robust gateways to the world of crypto trading for Australian investors. As the crypto market matures and evolves, the role of exchanges like CoinSpot and BTC Markets becomes increasingly significant in guiding and shaping the future of digital finance in Australia.

Crypto exchanges are more than just a means to trade; they are pillars of a broader ecosystem that brings together technology, finance, and innovative payment methods. The paths of these platforms diverge in their audience focus and feature sets, but together they underscore the vibrant nature of the cryptocurrency scene in Australia.

Their continued adaptation to market trends and user needs will likely be instrumental in the ongoing development of the sector.

CoinSpot vs BTC Markets: FAQs

BTC Markets is generally considered a good exchange. It’s known for its user-friendly interface, robust security measures, and reliable customer support.

It offers a range of cryptocurrencies and AUD trading pairs, which is convenient for Australian users. As with any exchange, it’s wise to consider its fee structure and the specific features you need before deciding if it’s the right fit for you.

If CoinSpot were to shut down, several things would likely happen. Firstly, there would be communication from CoinSpot regarding the shutdown process. Users would typically be given a time frame to withdraw their funds, either in cryptocurrency to another wallet or in fiat currency to their bank accounts.

If there were any legal or regulatory issues involved, the process might be overseen by regulatory bodies to ensure compliance and protect users’ interests. In such a scenario, it’s crucial to follow the official communications from CoinSpot and take prompt action regarding your assets.

Always remember to keep your cryptocurrency in a personal wallet where possible, as this reduces the risk of losing your assets if an exchange ceases operations.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.