Before we get into our step-by-step instructions on how to buy Ethereum in Australia, a quick crash course on buying crypto in general.

Cryptocurrencies can be bought through various Australian cryptocurrency trading platforms. Once you’ve signed up with one, you can log in, deposit money (preferably AUD) into your account.

And then you can use that money to buy and trade cryptocurrencies like Ether on the crypto exchange. Our favourite exchange is Swyftx, it’s easy to sign up and they have 70+ coins available for you to purchase (including Ethereum).

How To Buy Ethereum in Australia

- Register for an account with Swyftx.

- Enable 2FA (2-factor authentication).

- Verify your account.

- Deposit AUD into your account

- Click the “Trade” link

- Search for “Ethereum” and click on “Buy”.

- Enter the amount AUD you want to trade for ETH, or how much ETH you want to buy.

- Review the details.

- Click “Buy ETH”

Ethereum Price AUD

Find the ETH AUD price below:

Ethereum (ETH)

How To Get Started With Swyftx

1. Setup Your Account

As mentioned above, Swyftx is our go-to for trading cryptocurrencies in Australia, definitely if you’re starting out. It’s the most trustworthy exchange available and it makes trading buying, selling and switching coins incredibly easy.

After creating your account the first thing you’ll want to do is SETUP MFA (2-factor authentication, adds an extra step for logging in to your account, very easy to setup), you can find this on your Profile page under “Security”.

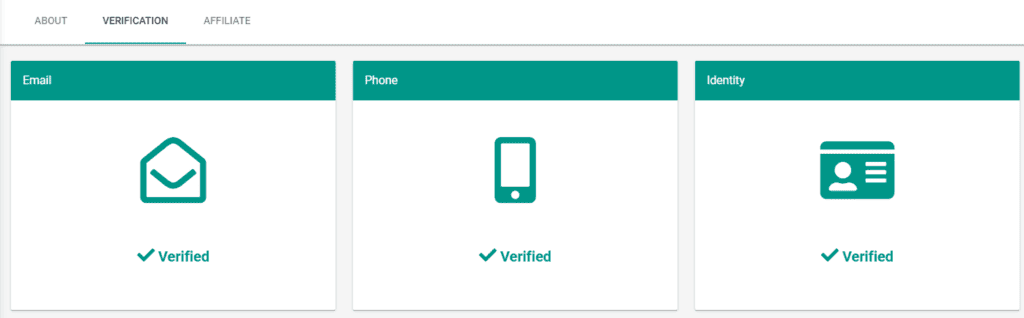

2. Verify Your Account

Before you do anything on Swyftx you’ll have to verify your account. It has the fastest verification process we’ve tested so it won’t take long.

Click in the left navigation bar on “Profile” then the “Verification” tab

You’ll have to verify your email, mobile number and identity to begin trading.

You will then have to fill in all of your personal information including documents, don’t be alarmed uploading this information, every exchange requires it. It’s to ensure your safety and make everyone on the platform accountable.

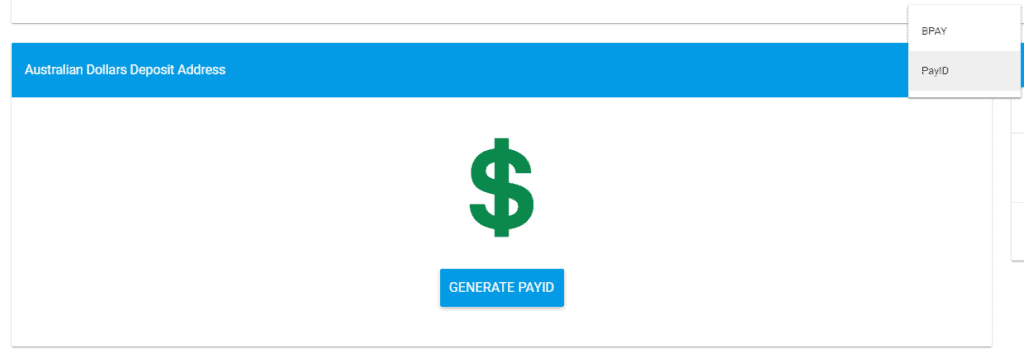

3. Deposit AUD

You’ll first need to deposit AUD on the platform so you can buy an sell cryptocurrency. You can also deposit Bitcoin straight into the platform if you already have some and would prefer trading with that.

Click the left navigation on Deposit AUD

You can then either choose BPAY or PayID to Deposit AUD on the platform.

4. Buy Coins

Once your account is verified and you’ve added AUD or BTC you can start buying and selling cryptocurrency.

Go to Trade

This page lists all the coins that Swyftx has available (which is a lot). You can simply click on any of the cryptocurrencies in the left section under “Assets” or search for your desired cryptocurrency.

Once you’ve decided what you want to buy you can indicate how much AUD you want to buy of each coin.

Easy as that! You now have bought some cryptocurrency. We highly recommend moving your cryptocurrency to a hardware wallet if you are planning on holding it for a while. If you are planning on day trading, or trading fairly regularly we suggest keeping it on the Swyftx platform.

Where To Buy Ethereum

We highly suggest using Swyftx to buy and sell Cryptocurrency. We’ve done a comparison of the top 10 exchanges in the world for Australians to use and Swyftx clearly deserves the top spot.

View our full review of the best crypto exchange in Australia.

Swyftx Exchange

Swyftx is by far our most recommended exchange for Australians. They have an easy to use platform and an online wallet that makes trading simple for new users. They have a strong sense of community and are constantly posting updates and adding new coins to their portfolio. On top of this they have low fees and are upfront about any transaction fees they do charge whereas some exchanges charge much more in spreads. This is the most trusted exchange in Australia and arguably one of the best exchanges globally.

What is Ethereum?

If you are not familiar with Ethereum, you are not alone. There are many people who do not understand or know what Ethereum is, but it would definitely be worth your time to learn about it. Ethereum is changing the world, and this is not an overstatement given that Ethereum has the opportunity to be one of the largest technological advances in recent memory.

Ethereum is an open-source platform that enables developers to create decentralised applications, also known as dApps. Currently, most websites and apps are centralized, meaning some person or entity has direct and full control over the application and any data associated with that application.

For example, all Facebook users rely on the Facebook corporation to maintain the platform and protect your information. Facebook keeps every content you upload, every information you share, and credit cards you’ve associated with your account on its servers and has full ownership and control over this information.

Ethereum aims to get rid of the traditional client-server relationship so that no one party has control or responsibility for maintaining the data and applications. Instead, the Ethereum blockchain will be responsible for this task.

A blockchain in simplified terms is a group of users or “nodes” on the network that work together to maintain the applications and data stored on the public blockchain. The nodes on the network earn “Ether” a tradable digital currency that can be used to pay for fees on the network or sold outright in exchange for other currencies.

Smart Contracts

The Ethereum blockchain is also capable of maintaining and facilitating smart contracts that will be executed based on the prewritten code.

Smart contracts are one of the most promising aspects of the rapidly advancing blockchain technology. Smart contracts have the opportunity to disrupt some of the largest industries in the world including banking, real estate, and even how governments operate.

Smart contracts are essentially a piece of code that is executed automatically based on a predetermined trigger, or triggers. Upon being triggered the smart contract automatically performs the action.

The benefit of this is that no central authority can alter or reverse the contract. Once the contract is active on the blockchain network, someone would need a majority of the network to approve a change to the contract, which would be next to, if not completely impossible.

You can develop any contract to be controlled and executed by computer code such as the transfer and recording of real estate transactions, exchange of financial instruments (equities or options), even a decentralized voting platform.

How to Pay for Ethereum Using Different Payment Methods

Buying Ethereum with Bank Transfer

You can purchase Ethereum via bank transfer on almost all of the popular Australian trading platforms such as Swyftx, Independent Reserve, CoinSpot, etc. All you need to do is link your bank account with your crypto exchange account. For banks to process your transfer, you’d typically wait between 3-6 business hours.

For European customers, SEPA bank transfers can be a cheaper alternative that incurs lower service fees. This option is not available on all cryptocurrency exchanges. Crypto Head recommends using Coinmama or eToro for this payment method.

Buying Ethereum with BPAY, Osko, POLi, and PayID

Nowadays, there are plenty of online payment services that facilitate (almost) instantaneous money transfers. Examples of these providers are Osko, BPAY, POLi, and PayID, all available to Australian traders via crypto exchanges such as Swyftx.

Now, Swyftx doesn’t charge any fees on crypto or fiat currency deposits up to $100,000 Australian Dollars but instead has a 0.8% spread included in the price of the digital assets. CoinSpot, on the other hand, charges 0.9% per BPAY transfer.

Buying Ethereum with Credit Card and Debit Card

Unfortunately, Australian crypto exchanges don’t support “paying with plastic” for your crypto assets. Ethereum traders based in Australia are welcome to use international trading platforms such as Coinbase or Coinmama.

Although convenient, these payments incur higher fees than bank transfers. On Coinbase, there’s a fixed 3.99% fee on debit card payments via Mastercard or Visa. The purchasing limit is $7,500 per week. In comparison, Coinmama has a higher 5.00% fee and a limit of $20,000 per month.

Buying Ethereum OTC

Crypto exchanges are great for average Ethereum purchases of less than $100,000. If you’re an institutional trader looking to purchase a larger ETH sum, you should use an OTC desk instead. Over-the-counter brokers like Circle, ItBit, and Genesis provide high liquidity on Ethereum purchases, state-of-the-art security measures, and fast processing times.

Australian traders would be happy to learn that the popular Australian platform Independent Reserve has launched an OTC desk as well. Binance and Kraken are some other international options.

Buying Ethereum with PayPal

Did you know that you can use your PayPal account to purchase Ethereum and other cryptos? The fees are generally higher than those for other payment methods so you can link your PayPal account to your bank account to use the money from your PayPal balance.

If you’re determined to purchase Ethereum directly through PayPal, try searching for PayPal exclusive offers on peer to peer networks like LocalBitcoins.

How to Store Your Ethereum

As a virtual currency, Ethereum is stored in a suitable digital wallet that safeguards your private key, i.e. your encrypted wallet address that unlocks your balance.

One option is to keep your coins in an online wallet if you trust the security measures employed by a certain crypto exchange or wallet provider. You can also download a software wallet and use it offline, but then it’s your responsibility to protect your computer or mobile device from malware.

However, one popular option for storing crypto long-term is hardware wallets. Hardware wallets are disconnected from the Internet and make it almost impossible for an outsider to gain access and steal funds.

A popular hardware wallet option is Ledger Wallet Nano S, which supports a range of cryptocurrencies and has a decent price. Upon activation, the wallet generates a recovery phrase that you should keep someplace safe and use it to reclaim your coins in case you lose the wallet.

Ride The Wave

Ethereum has the ability to change the world as we know it, and change the way people live their lives. It has the ability to safeguard data at a much higher rate than the organizations you read about having data breaches, at what seems like an increasing rate.

Ethereum has the ability to disrupt some of the largest multi-trillion dollar industries across the globe and take the power out of the hands of a select few and put the power in the masses. In Australia, you can even use Ethereum as part of a cryptocurrency-focused self-managed super fund.

It would be a good idea to stay updated and watch out for Ethereum and the applications that are built around the Ethereum blockchain. However, Ethereum is not the only crypto out there, so you can have a look at our page on buying cryptocurrencies in Australia. There’s “the king” BTC or Bitcoin (check out our guide on how to buy bitcoin in Australia), there’s also NEO, dubbed “the Ethereum of China”, and other altcoins like Bitcoin Cash, Monero, IOTA, Verge, Ripple (XRP), and Litecoin (LTC).

Frequently Asked Questions

How Long Will It Take to Mine 1 ETH?

The hash algorithm used by miners on Ethereum’s blockchain allows them to generate a new block of ETH in 12 seconds compared to Bitcoin’s 10 minutes per block.

How Can I Get Free Ethereum?

The only way to get Ethereum for free is to visit some online platforms that offer a small portion of 1 ETH once you watch a couple of their videos or complete some kind of surveys because this helps increase their website traffic.

How Do You Make Money With Ethereum?

One way to make money with Ethereum is to hold to your coins long-term and wait for their price to grow higher over time. Another option is to invest in Initial Coin Offerings (ICOs) built using the Ethereum network. Moreover, if you’re a developer, you could learn Ethereum’s programming language Solidity and make money by helping the network develop new decentralized applications.

Can You Sell Ethereum/Convert Ethereum to Cash?

If you own ETH and want to cash out your profit, you can sell them on a cryptocurrency exchange. Selling them might take longer because you need to wait for the exchange to find a suitable buyer but simply withdrawing ETH to your bank account incurs extra fees.

Which Ethereum Exchange Is Better: Coinbase or CEX.io?

Coinbase and CEX.io are two reliable Ethereum platforms. Coinbase is an international exchange based in the United States while CEX.io comes from the UK crypto market. However, neither of these platforms is ideal for Australian traders as they can’t make an AUD deposit. They can deposit funds via ACH or SEPA bank transfers, credit/debit cards, and wire transfers, but their AUD will be converted into USD, EUR, or GBP.